This Thursday, the Planning Commission will consider legislation to more than double the Jobs Housing Linkage Fee (“JHLF”) on both office and laboratory uses. The Jobs Housing legislation is authored by Supervisor Matt Haney and co-sponsored by five other supervisors (Fewer, Ronen, Mar, Peskin, and Walton) who, together, comprise a majority of the Board of Supervisors.

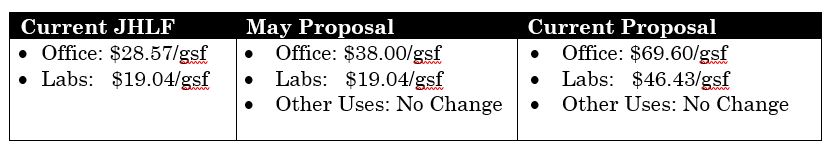

The JHLF was first established in the 1980s and applies to commercial projects over 25,000 square feet. In May of this year, Supervisor Haney introduced legislation to increase the JHLF on office to $38.00 per square foot, an approximate $10 increase over the current rate. Last week, Supervisor Haney modified the legislation to propose an office rate of $69.60 per square foot and a rate of $46.43 per square foot of lab space. A comparison of current and proposed rates follows:

The legislation does not include grandfathering for pipeline projects. For most projects, the higher fee would be collected at the “first construction document” (usually a building permit or foundation addendum to a site permit) for a project. However, the higher fee could also be retroactively collected from projects with issued permits if they were approved by the Planning Commission or Department before the end of 2019 with a condition that they would be subject to a higher JHLF. Prior to receiving a Certificate of Occupancy, these projects would be required to pay the difference between any fee assessed at site permit issuance and the higher fee effective when the Certificate of Occupancy is issued.

The Planning Department has expressed its support for “the overarching aim of the Ordinance” to generate funding for affordable housing, but expressed strong concerns about the proposed rates:

“Imposing development impact fee rates above those found feasible would postpone or halt the construction of a Development Project. Any public benefit revenue or public improvements that were expected from such projects would not materialize and would necessarily be postponed or abandoned until such time as market conditions or policy changes make the rates feasible…[H]undreds of millions of dollars’ worth of public recreation and open space projects, pedestrian and bicycle safety improvements, cultural preservation, and affordable housing would not materialize with an infeasible rate.”

Planning staff recommends setting the rate for office uses no higher than $38.57 per square foot “in accordance with feasibility assessments” prepared by the city’s consultants earlier this year. Because those assessments did not include an analysis of laboratory uses, Planning staff “cannot recommend increasing rates for this use.”

In fact, the feasibility assessment prepared for the City concluded that “[n]one of the tested office prototypes appears financially feasible based on current market conditions.” A combination of construction and land costs, along with other newly imposed community benefit costs, including impact fees, special “community facilities” taxes, and Prop. C commercial rent taxes, have added to the overall cost burden. Further fee increases only became feasible when a hypothetical 25 percent reduction in land value and construction cost were factored in, along with a hypothetical 13 percent increase in rent. With those assumptions, three of six prototypes are thought to be feasible with a $5/gsf increase in the JHLF; only one of six would be feasible with a $10/gsf increase.

The Planning Commission will hear the legislation this Thursday afternoon in City Hall, Rm. 400. The agenda, including supporting documents for the JHLF legislation, is available here: https://sfplanning.org/sites/default/files/agendas/2019-09/20190919_cal.pdf.

Authored by Reuben, Junius & Rose, LLP Attorney’s Daniel Frattin and Justin Zucker

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.