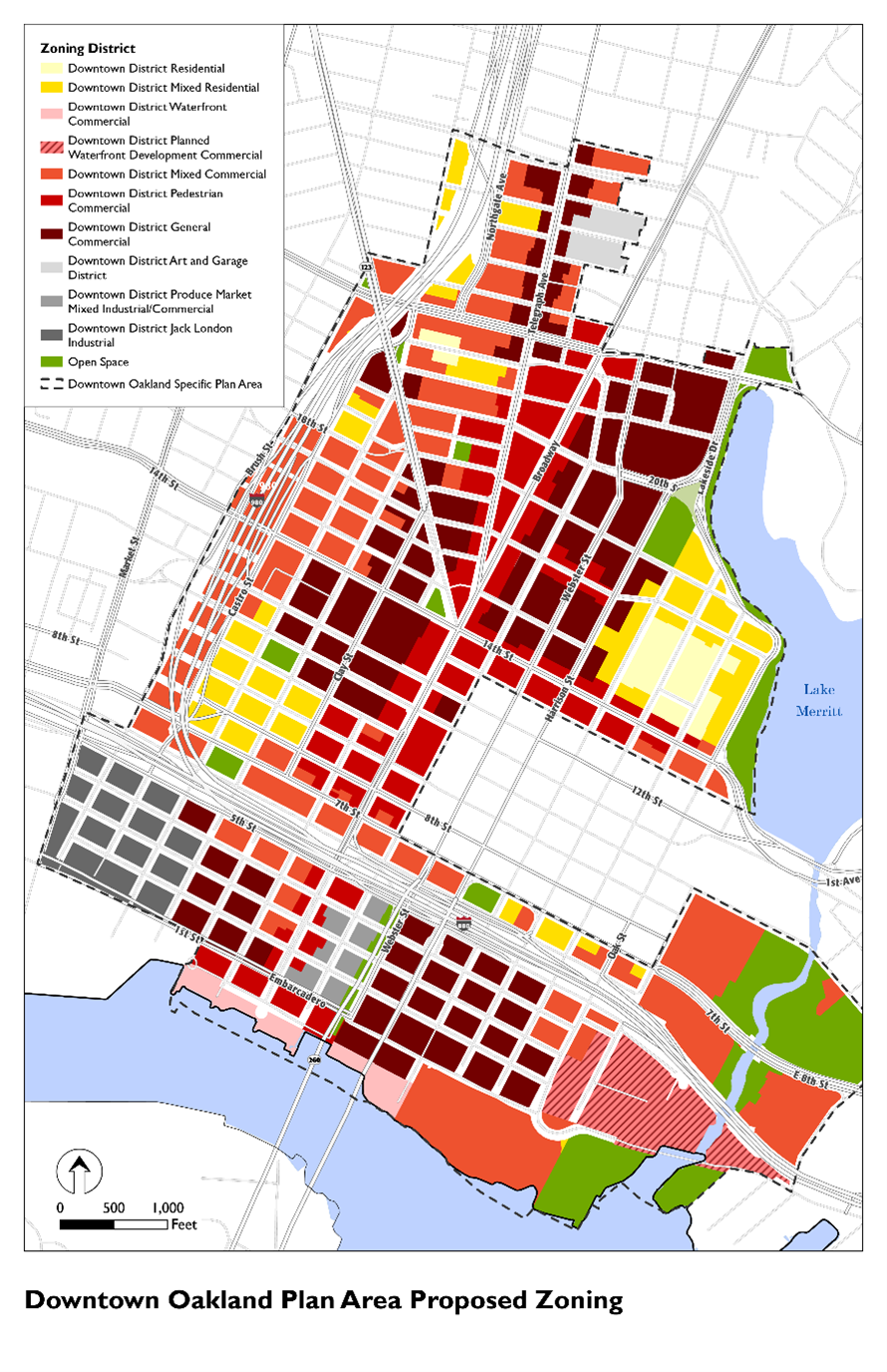

The Downtown Oakland Specific Plan (“DOSP”) is Oakland’s sixth area plan and has been in the works since the mid-2010s. On April 27, 2022, Zoning Code Amendments to implement the objectives of the DOSP were released. The DOSP’s objectives, include new and equitable housing production, economic opportunity, social justice, culture keeping, quality urban form, climate-friendly mobility, and climate-responsive development.

The Zoning Amendments consist of changes to both the Oakland Zoning Map and the Planning Code.

Key elements of the proposed Zoning Amendments include:

- Establish a Zoning Incentive Program. The Zoning Incentive Program allows developers to elect to provide one or more community benefits, or pay a fee to the city to fund such benefits, in exchange for increases in allowable building height and/or density. Community benefits in the Zoning Incentive Program were selected to increase housing affordability, provide affordable rent for small businesses, train Oakland’s workforce, and create resources that support public health. Details of the Zoning Incentive Program have yet to be released and are expected sometime in mid-May.

- New area-specific regulations. The current Central Business District includes four zoning districts and will increase to ten, each with development standards and allowable uses tailored to specific conditions, objectives, and geography.

- High-density efficiency units. Allowing for dwelling units of 500 square feet or less at a higher density than regular dwelling units.

- Office Priority Combining Zone. Establishing an Office Priority Combining Zone within which properties must dedicate at least sixty percent of building floor space to office uses before other uses are allowed.

- Green Loop Combining Zone. Establishing a Green Loop Combining Zone to provide safe, inviting pedestrian connections between commercial, cultural, recreational, natural and entertainment areas of the Downtown District. Controls include the provision of pedestrian-oriented amenities along ground-floor storefronts and development standards for attractive, inviting open space between buildings and sidewalks.

- Transfer Development Rights (“TDR”) program. Establish a TDR program to protect historic buildings from demolition by allowing their owners to sell development rights to owners of sites in less historic areas of downtown.

The DOSP has undergone revisions in response to extensive community review of the draft released in 2019. In conjunction with release of the Zoning Code Amendments, the Planning and Building Department will be hosting several additional community outreach meetings and hearing in the coming months. Individuals interested in the DOSP and its Zoning Amendments are encouraged to attend one or all of the following upcoming meetings:

- Special Districts, May 16 6:00-7:30 p.m.

- Development Standards and Zoning Incentive Program, June TBD 6:00-7:30 p.m.

- Community Advisory Group (CAG) Meeting, TBD

- Zoning Update Committee (ZUC) Hearing, TBD

Later this year, the City Council is anticipated to consider both the Final Draft Zoning Amendments and Final DOSP for adoption.

Reuben, Junius, & Rose LLP has experience with entitlement projects and land use diligence throughout Oakland, and we are pleased to have worked on some of the largest housing projects approved in the city over the last several years. We will continue to track this significant rezoning and community planning effort as it moves forward.

Authored by Reuben, Junius & Rose, LLP Attorney Justin A. Zucker.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.