Senate Bill 9 (SB 9), which took effect January 1, 2022, enables property owners to split their single-family residential lot into two separate lots and build up to two new housing units on each lot. A key component of SB 9 is that it requires ministerial approval of such projects. In San Francisco (the “City”), that means no discretionary review process and other opportunities for project opposition. The City’s policymakers and housing advocates were influential in the adoption of SB 9. And yet, now that it’s here, the City’s lawmakers can’t seem to decide if they like SB 9.

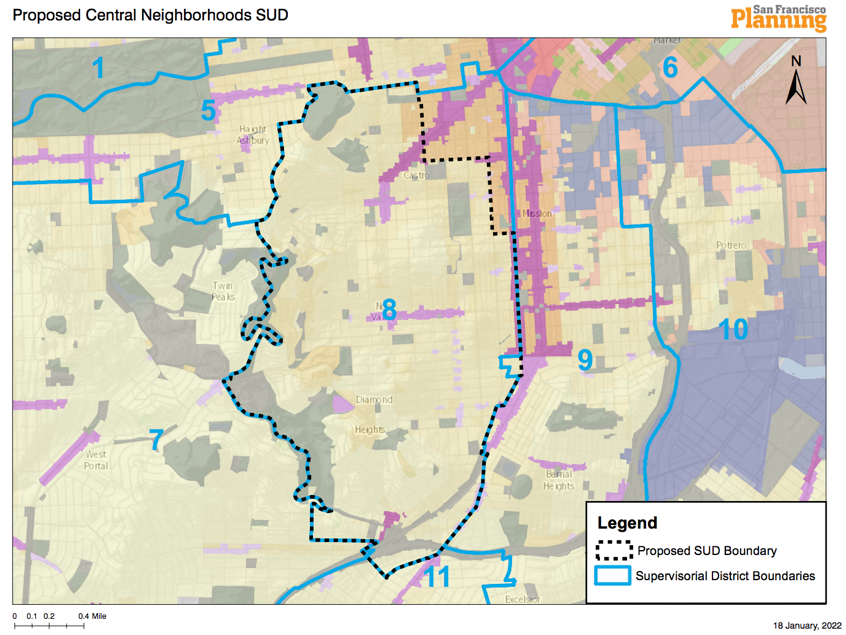

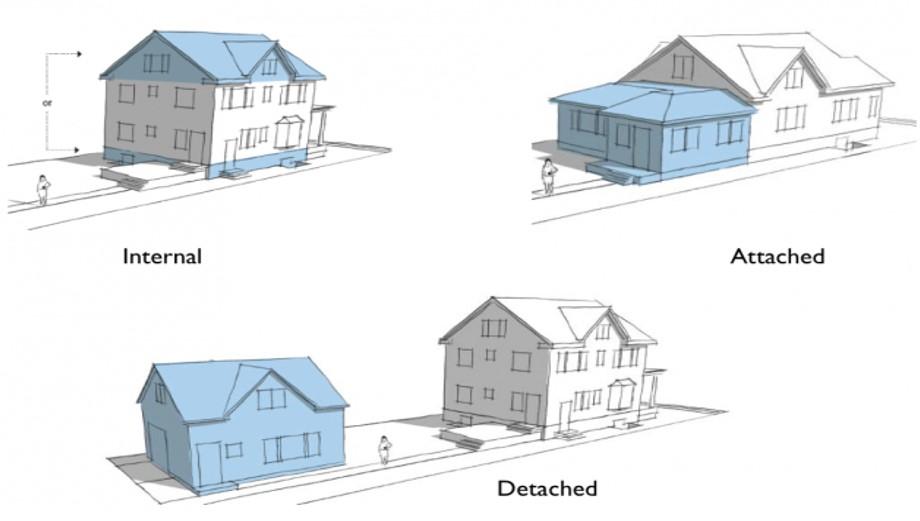

Housing advocates hailed SB 9 for facilitating the construction of new, smaller dwelling units throughout the City. Everyone can agree that the City needs housing. However, the City’s new housing production in recent years has been heavily concentrated in the eastern and southeastern parts of the City, with 90% of all new housing produced in just ten eastside and central neighborhoods. Development in these neighborhoods has at times been subject to significant conflicts and prevented from moving forward. At the same time, roughly 60% of the City’s developable land area is in residential zoning districts, concentrated primarily on the City’s west side, with 38% of the City’s developable land area zoned exclusively for single-family homes. Just 3% of housing built since 2005 was added in areas that allow one to two units (only 6% of affordable housing when ADUs are counted). SB 9 presents a fresh approach.

When Supervisor Rafael Mandelman proposed his “fourplex” legislation last summer, allowing any single-family home to be turned into a fourplex, and corner lots to have six units, it seemed SB 9 would be embraced, and that some of the City’s more vexing housing challenges would be addressed. It wasn’t that easy.

Last Monday (April 11), the Board of Supervisors’ Land Use Committee considered Supervisor Mandelman’s fourplex legislation. Supervisor Mandelman, facing significant political push-back, had amended his legislation to upzone all single-family residential districts (RH-1 and RH-1(D)) in the City to two-family density (RH-2 and RH-2(D)). The elimination of single-family zoning is a means of ensuring the approval of new fourplexes and six-unit projects would not be ministerial, and that discretionary review of these projects would continue. This is because the ministerial provisions of SB 9 apply only to single-family residential districts.

Advocates of preserving the discretionary review process cite the need for the City to maintain design review control over new housing. But discretionary review is not about design review. Discretionary review has become a process that project opponents manipulate to stop new development. It adds significant time, cost, and risk to the production of housing, thereby discouraging new units. If design review is the concern, there are better ways to accomplish that without leaving it to discretionary review.

Other related issues addressed by Supervisor Mandelman’s legislation include residency and tenancy controls, measures to prevent demolition, condominium conversion and subdivision controls, and rent protections.

In the end, at the Land Use Committee on Monday, the Committee approved certain amendments proposed by Supervisor Melgar that sought to encourage larger units, incentivize marginalized homeowners to create more units, and waive the application fees for Historic Resource Assessments, and then voted to continue its consideration of the legislation to the April 25 meeting.

Authored by Reuben, Junius & Rose, LLP Attorney Thomas P. Tunny.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.