This week’s client alert discusses three pro-housing bills sponsored by Bay Area legislators that are pending in Sacramento: Buffy Wicks’ AB 2011 cleanup bill; a bill adding a new streamlining option for converting commercial buildings to residential authored by Matt Haney; and Scott Wiener’s proposal to extend the performance period of certain entitled but not built housing projects by two years, and allow those projects to defer certain impact fees until their certificate of occupancy.

For background, according to UC Berkeley’s Terner Center for Housing Innovation, over 215 housing-related bills were introduced in California’s 2024 legislative session, representing almost 10% of all new bills. Topics include streamlining, tenant protections, potential solutions to construction cost issues, and addressing impediments to housing production in the Coastal Zone, among other topics. It should come as no surprise that the Bay Area caucus is at the forefront of legislation to increase housing production.

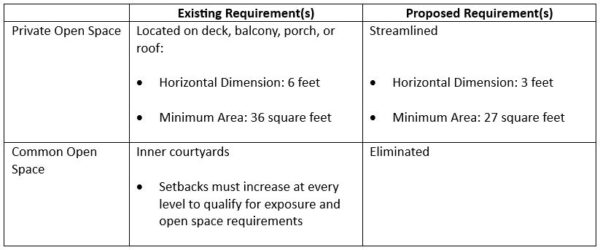

Assemblymember Wicks’ AB 2011 cleanup bill, AB 2243, would make several technical amendments that help clarify the scope and applicability of this streamlined ministerial program for housing on sites that principally permit commercial uses. It also loosens a few eligibility criteria, potentially opening up more sites for the program, and changes some AB 2011-specific zoning controls. The bill would:

- Allow sites facing a road 50 feet or wider to use AB 2011, if the height limit at the site is 65 feet or higher (currently, the minimum street width is 75 feet).

- Remove the prohibition on AB 2011 projects within 500 feet of a freeway and 3,200 feet of a refinery if the project provides enhanced air filtration systems.

- Allow AB 2011 on: sites where parking is allowed with a Conditional Use permit; qualifying regional malls; office buildings converted to residential; and sites near public parks and parking lots or structures.

- Prohibit cities from imposing higher local inclusionary requirements unless they can demonstrate that the project is economically feasible. Otherwise, the project will be subject to AB 2011’s own on-site inclusionary requirements of 8-15% for rental projects and 15-30% for condos (with a sliding scale based on AMI levels).

- Increase minimum residential density for ground-up construction and eliminate density limits for conversion projects.

- Clarify that the residential density limits for an AB 2011 project can be increased using the Density Bonus Law (“DBL”), and that AB 2011 projects in the Coastal Zone can use the DBL’s additional density, waivers, and concessions even though they would need to get a coastal development permit.

Assemblymember Haney’s adaptive reuse program (AB 3068) makes the approval process for converting qualifying buildings streamlined and ministerial. It borrows many concepts from AB 2011 and SB 35/423 including imposing the same processing timelines and requiring prevailing wages, apprenticeship programs, and health care expenditures for construction workers. Sites need to be in urbanized areas and surrounded by other urban uses and cannot propose the conversion of light industrial buildings. A minimum of 50% of an existing building must be converted, allowing buildings to retain non-residential uses. The project would also need to comply with either a local jurisdiction’s inclusionary housing program or the bill’s own requirements, whichever is higher.

Interestingly, the adaptive reuse program would also allow the development of new buildings on undeveloped areas and parking adjacent to the commercial building proposed to be converted, if certain criteria are met. It would also allow the new construction aspect of the project to use the Density Bonus Law.

Also, AB 3068 would allow but does not require cities and counties to offer financial incentives for up to 15 years to subsidize affordable units that are part of an adaptive reuse project. The annual payments to property owners would be equal to the amount of property tax revenue that the local government receives, less the assessed valuation when the sponsor applied for the payment program.

Finally, Senator Wiener’s bill—SB 937—would grant a two-year extension to the performance periods of certain residential projects. Projects entitled under any of the following programs would be eligible for the automatic extension: AB 2011, SB 35/423, the Density Bonus Law, Yes in God’s Backyard (SB 4), 100% affordable projects, and projects with 10 or fewer units. The project needs to have at least 2/3 residential square footage, and the entitlement needs to be issued prior to and still be in effect as of January 1, 2024.

Senator Wiener’s bill also would delay the payment of development fees used to construct public facilities or improvements until a certificate of occupancy is issued. And it would not allow a city to charge interest on deferred fees. These changes could increase the financial feasibility for housing developments by allowing project sponsors to defer payment until after construction is complete.

We will continue to track these and other notable bills as they navigate the legislative process.

Authored by Reuben, Junius & Rose, LLP Partner, Mark Loper.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.