This year was a blockbuster year for housing legislation coming from Sacramento. Last week, Governor Gavin Newsom signed into law more than three dozen bills related to housing and housing production. Below please find a brief overview of twelve housing bills signed by the Governor that become effective next year.

AB 682. Density Bonus for “Shared Housing” Buildings

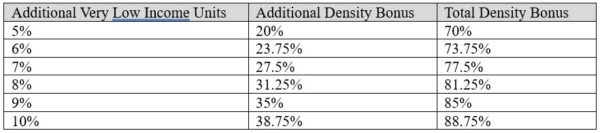

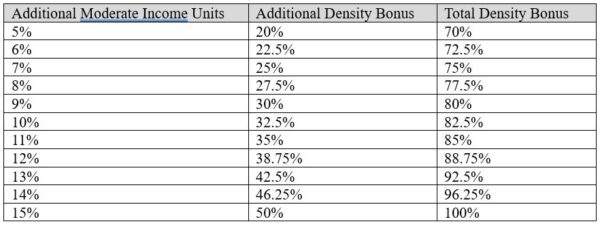

AB 682 amends the State Density Bonus Law to create a density bonus for “Shared Housing” developments. Shared housing, or group housing as it is commonly known, is characterized by single-room units with shared access to common kitchen and dining facilities. Each unit is typically intended for one or two occupants and features a small kitchenette. This new density bonus will allow shared housing developments to build at greater densities in exchange for dedicating a percentage of units to affordable housing, with the same affordability requirements and bonus amounts as is currently available to standard-unit developments. Notably, shared housing developments can provide up to 25% of their floor area as standard-unit housing and still qualify for a density bonus.

AB 916. No Public Hearing to Increase Bedroom Count

AB 916 prohibits cities from requiring a public hearing for a permit to add up to two bedrooms by reconfiguring existing space within an existing dwelling unit.

AB 1551. Commercial Development Bonuses for Providing Affordable Housing

AB 1551 creates a density bonus for commercial developers who partner with housing developers and support the provision of affordable housing through land donation, cash payment, or by directly building units. A commercial developer is eligible for up to a 20% density bonus. To qualify, the housing development supported by the commercial developer must provide either 30% of units as affordable for low income (<80% AMI) or 15% of units as affordable for very-low income (<50% AMI).

AB 2011. Affordable Housing and High Road Jobs Act

AB 2011 provides streamlined, ministerial approval of multifamily housing developments that contain affordable housing units located in commercial zones. Two tiers of development are available, depending on the amount of affordable housing provided. A project dedicating 100% of units as affordable for lower income households can be developed by right on most parcels zoned for retail, office, or parking uses. A project with market-rate units that provides a specific percentage of rental or ownership units as affordable for either lower income or very-low income households can be developed by right on parcels zoned for retail, office, or parking if the site has at least 50 feet of frontage on a commercial corridor (a street between 70 and 150 feet wide). AB 2011 projects are also subject to certain prevailing wage and skilled workforce requirements. We have discussed AB 2011 in greater detail in previous updates on August 24, 2022, and September 1, 2022.

SB 6. Middle Class Housing Act

SB 6 is intended to increase the development potential for middle-income housing by principally permitting housing developments that meet specific criteria in areas zoned for office, retail, or parking uses. Eligible developments are required to meet or exceed certain density thresholds established in the state’s Housing Element law, such as 30 units per acre in metropolitan settings or 20 units per acre in suburban settings. SB 6 projects must also meet certain prevailing wage and skilled and trained workforce requirements, although a development can be exempted from these in certain circumstances.

AB 2334. Density Bonus in Very Low Vehicle Travel Area

AB 2334 expands the available density bonus for 100% affordable housing developments in very low vehicle travel areas. A “very low vehicle travel area” is a transit analysis zone where existing residential development generates 85% or fewer vehicle miles traveled per capita than the regional area in which it is located. Qualifying density bonus projects are not subject to maximum density controls, are entitled to up to 4 development incentives, and may receive an additional three-stories of height. This additional density bonus is only available in the counties of the Bay Area, Sacramento, the Southern Coast, and Inland Empire. AB 2334 also clears up the grey area for application of the state density bonus in a form-based zoning district, requiring calculation of an “average unit size” multiplied by the density bonus amount to determine increase in floor area allowed.

AB 2653. Housing Element Reporting

AB 2653 alters some of the requirements for annual housing element reports cities must submit to the state. Cities must include greater detail, including the numbers of all new and demolished housing units in the jurisdiction, as well as data on all approved density bonus projects. AB 2653 also provides a mechanism for the state to request corrections and make referrals for enforcement.

AB 2668. SB 35 Streamlining Updates

AB 2668 amends SB 35 clarifying streamlined SB 35 projects are not subject to any non-legislative discretionary approval and that density bonus units are not considered when calculating whether a project satisfies SB 35’s affordability requirements. Further, the bill prohibits cities from denying an application for missing materials if there is enough information to allow a reasonable person to conclude the development is consistent with the applicable objective standards. AB 2668 also brings important change to how the Cortese List affects SB 35 eligibility. Placement on the Cortese List, which is the aggregate of the state’s decentralized hazardous waste sites databases, disqualifies a site from SB 35, until it is cleared for residential use by the authority having jurisdiction. However, longstanding confusion over the mechanism of clearing a site meant that once a site was listed, it was effectively barred from SB 35 permanently, even if it had undergone extensive remediation. AB 2668 establishes specific criteria, documentation, and agency determinations that allow a “listed” site to qualify for SB 35.

AB 2221 & SB 897. ADU Law Updates

AB 2221 and SB 897 make a number of changes to existing ADU law to provide for greater development flexibility and ensure consistent and efficient project review. Under these bills, a city that denies an ADU application will be required to provide a full set of written comments that includes a list of all deficient items and details how the application can be remedied. These comments must be provided within the existing 60-day review period. Additionally, a city will be prohibited from denying an ADU application based on nonconforming zoning conditions, building code violations, or unpermitted structures that are not affected by the ADU construction and do not pose a threat to safety.

The bills also increase ADU development potential by restricting setbacks that prevent ADUs below a minimum floor area, increasing the minimum height limit for ADUs located near transit stops or attached to primary dwellings, and prohibiting owner-occupancy requirements until January 1, 2025. Importantly, the addition of an ADU will no longer constitute a change of R occupancy under the building code such as from an R3 (single-family or duplex) to an R2 (multi-family), and will not trigger a requirement for fire sprinklers if not previously required.

AB 2234. Post-Entitlement Permit Processing

AB 2234 focuses on post-entitlement non-discretionary building permit processes after the planning process has concluded and environmental review is complete. AB 2234 requires local agencies to compile a list of information need to approve or deny a post-entitlement permit, a checklist and post an example of a completed, approved application. AB 2234 also sets timelines for review of post-entitlement applications for housing projects: (a) for projects with 25 units or fewer, a local agency shall complete first review and comment within 30 days of an application completion; and (b) for projects with 26 or more units, a local agency shall complete first review and comment within 60 days of an application completion. These time limits are tolled if a local agency requires review of an application by an outside third-party reviewer. Failure to meet these timelines is a violation of the Housing Accountability Act.

Authored by Reuben, Junius & Rose, LLP Attorneys Justin A. Zucker and Daniel J. Turner.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.