Last month, the San Francisco Board of Supervisors passed on first reading Impact Fee Reform legislation aimed to make development more predictable, easier, and financially feasible. The legislation complements the proposed BMR and impact fee changes our office previously reported on and will:

- Reinstate the fee deferral program;

- Escalate development impact fees by 2% each January;

- Allow projects to lock in the type and rate of impact fees to be paid;

- Waive development fees for a narrow category of projects; and

- Adopt a nexus analysis that was completed in December 2021.

The Impact Fee Reform legislation is a part of the City’s efforts at recovery from the pandemic and is meant to supplement efforts to accomplish the policy goals outlined in the updated Housing Element that was adopted earlier this year. Inclusionary housing development impact fees are specifically excluded from the scope of the legislation, so would not be affected.

Below is a brief summary of the changes proposed by the legislation:

Fee Deferral Program

The legislation would reinstate and modify a Fee Deferral Program that expired in 2013 to allow project sponsors to defer 80%-85% of total development impact fees, except inclusionary affordable housing fees. For projects that opt to defer fees:

- Generally, projects subject to a neighborhood infrastructure impact development fee would be required to pay 20% of the total amount of development fees owed prior to issuance of the first construction document;

- For projects not subject to a neighborhood infrastructure impact development fee, project sponsors would be required to pay 15% of the total amount of development fees owed prior to issuance of the first construction document.

The remaining percentage of fees must be paid before issuance of the first certificate of occupancy. To obtain deferral, the project sponsor must submit a deferral request to DBI on a form provided by DBI before issuance of the first construction document. Fee deferral is not available to project sponsors that pay the fee before the effective date of the legislation. Projects subject to a development agreement would be eligible for fee deferral, unless otherwise agreed by the parties.

Development Fee Indexing

The legislation would replace and simplify the current method of annual fee escalation with a 2% escalation rate every January 1st.

Development Fee Assessment

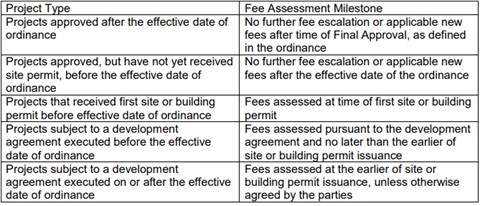

The legislation proposes to freeze the rates of development impact fees as follows:

Additionally, the legislation institutes new procedures for assessing development impact fees when a development project requires a modification, renewal, or extension.

Development Impact Fee Waivers for Certain Projects

The legislation would also waive development impact fees for certain projects. Eligible projects that obtain a final approval before the effective date of the ordinance that have not already paid development impact fees are eligible for waiver. Waiver under the legislation is set to expire on December 31, 2026.

Projects in Production, Distribution, and Repair (“PDR”) Districts:

Within PDR Districts, projects that meet the following requirements are eligible for waiver from development impact fees related to establishing new PDR or retail use:

- Located in a PDR District;

- Contain a retail or PDR use and no residential uses;

- Propose new construction of at least 20,000 square feet of Gross Floor Area (“GFA”) and a maximum of 200,000 square feet of GFA;

- Located on a vacant site or site improved with buildings with less than a 0.25:1 Floor Area Ratio on the date a development application is submitted; and

- Submit a complete development application on or before December 31, 2026.

Projects in C-2 and C-3 Districts

Within C-2 and C-3 Districts, projects that meet the following requirements are eligible for waiver from development impact fees related to establishing hotel, restaurant, bar, outdoor activity, or entertainment use:

- Located in a C-2 or C-3 District;

- Contain hotel, restaurant, bar, outdoor activity, or entertainment use; and

- Submit a completed development application on or before December 31, 2026.

Authored by Reuben, Junius & Rose, LLP Attorney Kaitlin Sheber.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.