On Tuesday, the San Francisco Board of Supervisors passed legislation increasing the Jobs Housing Linkage Fee (“JHLF”) for office and laboratory projects. While some grandfathering applies to pipeline projects, as of January 2021 new large office projects will be assessed the JHLF at a rate of $69.60 per gross square foot (“gsf”); smaller office developments at a rate of $62.64; and laboratory projects at a rate of $38.37/gsf.

The JHLF was created in the 1980s and applies to projects citywide that increase by 25,000 gross square feet (“gsf”) or more any combination of office, retail, hotel, integrated PDR, laboratory or small enterprise workspaces uses. The Fee is intended to account for the increased housing demand created by new commercial construction.

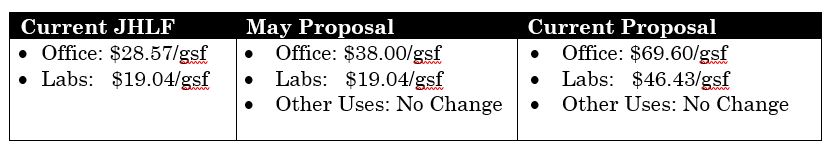

Until now, the JHLF program allowed developers to choose between paying an in lieu fee or dedicating land of equivalent value to a housing developer for construction of affordable housing (although the land dedication option was rarely used). Projects within the Central SoMa Special Use District also have the alternative of dedicating land to the City for affordable housing production. The JHLF is currently assessed at a rate of $28.57/gsf for office use, and $19.04/gsf for laboratory.

Last May, District 6 Supervisor Matt Haney introduced legislation to raise the JHLF on office to $38.00/gsf – about $10 over the current rate. Then in September he introduced modified legislation with much steeper rates: $69.60 /gsf for office and $46.43/gsf for laboratory, with no grandfathering for pipeline projects. The legislation did not increase the JHLF for retail, hotel, or small enterprise workspace development.

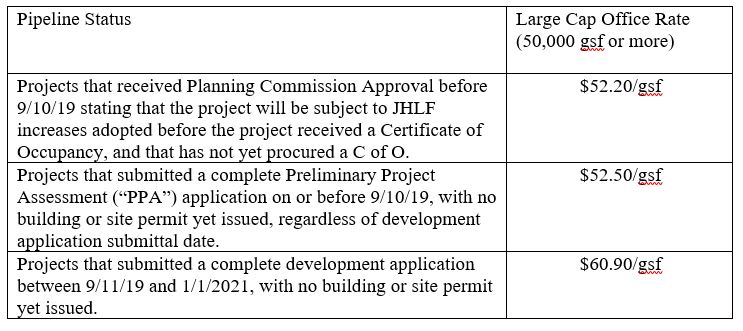

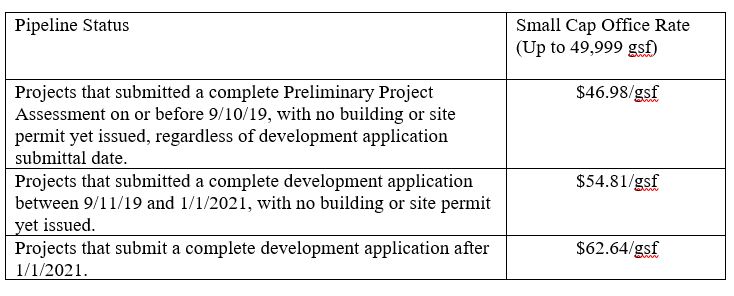

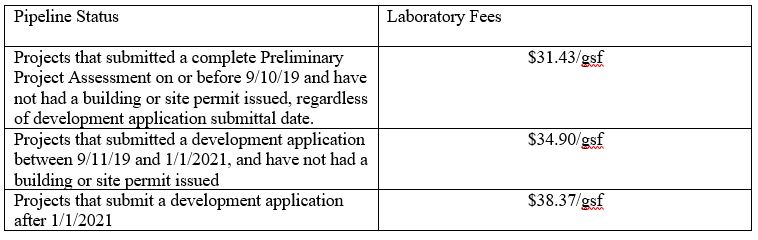

On October 21st, amended legislation was introduced at the Board’s Land Use Committee, providing some grandfathering for pipeline projects by phasing-in rate increases between now and January 1, 2021. On October 29th, additional amendments were introduced at the full Board, differentiating fee rates for large-cap (> 50,000 gsf) versus small-cap (49,999 gsf or less) office projects. The final JHLF legislation fee rates are summarized below.

Large-Cap Office (50,000 gsf or more):

Small Cap Office (49,999 gsf or less):

Laboratory:

In addition, Tuesday’s legislation makes the following modifications to the JHLF:

- Requiring the fee to be indexed annually according to the Annual Infrastructure Construction Cost Inflation Estimate, consistent with most other City development impact fees;

- Eliminating application of JHLF to “Integrated PDR,” a defunct use category;

- Allowing projects citywide to comply with the JHLF through land dedication to the City, but removing the formerly-available option of compliance through payment of a fee or land dedication to another housing developer;

- Requiring sponsors of large-cap office projects approved by the Planning Commission before 9/10/19, which contain approval language stating that the project will be subject to JHLF increases adopted before the project received a Certificate of Occupancy [essentially “key sites” in the Central SoMa Plan area], to pay the difference in JHLF assessed at the time of site permit issuance and the rate due under the legislation ($52.20) prior to issuance of a Certificate of Occupancy; and.

- Requiring the JHLF Nexus study to be updated every five years.

The JHLF legislation was approved by Board on Tuesday, and will become final unless disapproved by the Mayor within 10 days. Pending Mayoral action, it is anticipated to take effect in December 2019.

Authored by Reuben, Junius & Rose, LLP Attorney Melinda Sarjapur

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.