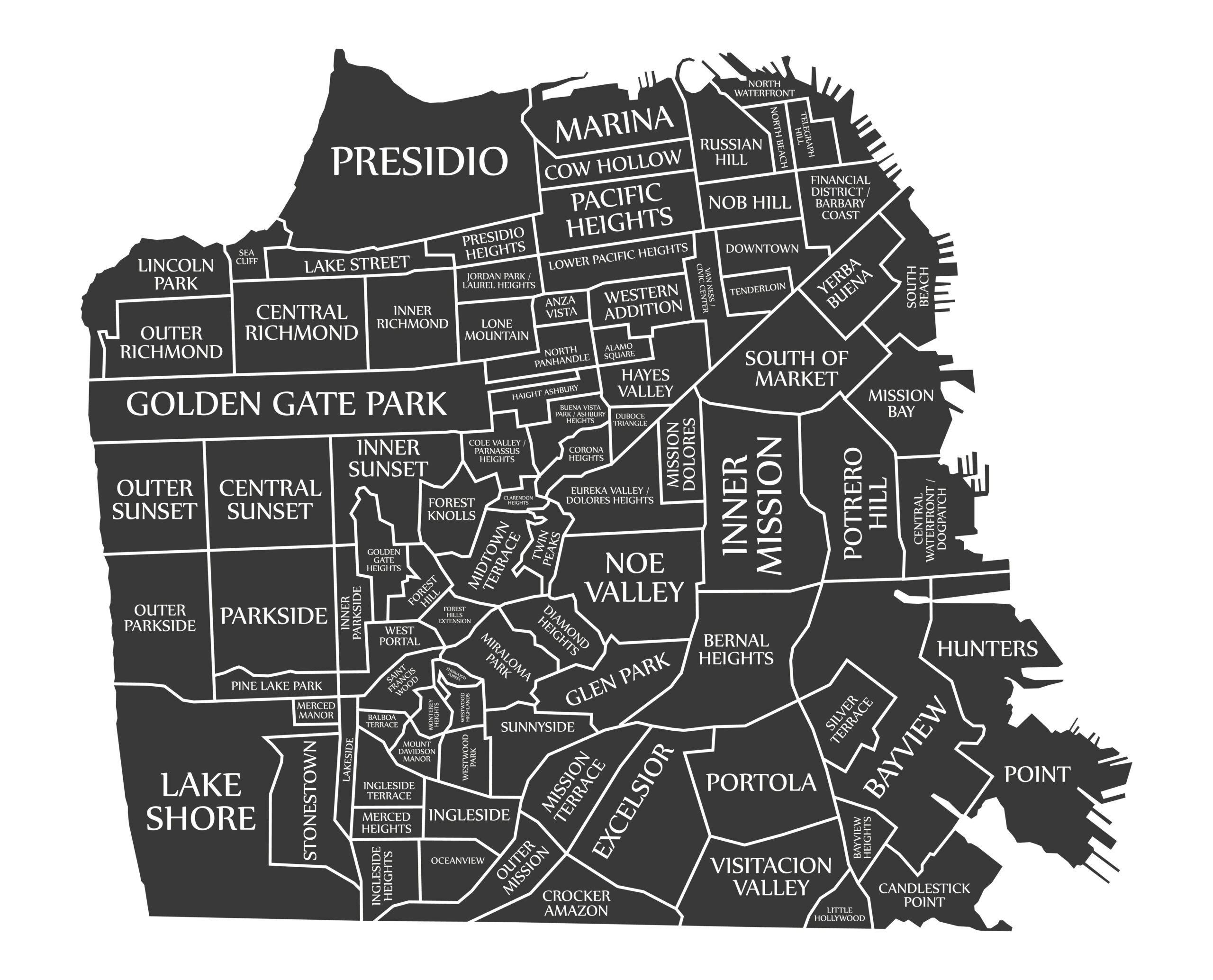

Recently, Mayor London Breed and Supervisor Joel Engardio introduced an ordinance removing some of the Planning Code’s regulatory barriers to housing. A major implementing measure of San Francisco’s recent Housing Element, it is rich in detail and nuance and proposes a range of common-sense changes to increase housing production. Below, we summarize some of the major aspects of the proposal captured in the first draft of the ordinance, broken up into two sections: process streamlining, and relief from certain building design and density restrictions. Process Streamlining Eliminating conditional use requirement for certain developments. Automatic conditional use (“CU”) approvals for developments on certain “large lots” in neighborhood commercial districts would be eliminated. Similarly, CU requirements for buildings taller than 40-50 feet in RH, RM, RC, and Broadway NC districts would be eliminated, as would buildings taller than 50 feet along the Van Ness Special Use District. This would unlock the development potential of many sites where the height limit is comfortably above the 40-50 foot CU threshold. HOME–SF. HOME-SF would be modified to allow projects on sites where a single-family home exists and is proposed to be demolished, and to remove a requirement that the Planning Department’s Environmental Review Officer determine the project will not have any adverse wind, shadow, or preservation impacts. Dwelling unit demolitions. Outside of the “priority equity” areas of San Francisco—which are neighborhoods with a higher density of vulnerable populations; see the map at the bottom of this alert—some residential demolition projects will not require a CU. The project cannot remove more than two residential units; the units to be demolished cannot be tenant occupied or have a history of evictions within the last 5 years; the building cannot be an historic resource; the project needs to add at least one more unit than is proposed for demolition; and the unit needs to comply with the Housing Accountability Act’s protections for replacement units and recent tenants. Design and Density Regulation Changes Increased residential density in RH districts. The ordinance would eliminate the need for a conditional use (“CU”) to exceed the one- to three-unit base density in RH districts. And, it would principally permit one unit per 3,000 square feet of lot area in the three RH-1 districts; one unit per 1,500 square feet of lot area in RH-2; and 1 unit per 1,000 square feet of lot area in RH-3, exclusive of any ADUs. Also, residential projects in RH zones that meet certain eligibility criteria currently can have up to six units on corner lots, and up to four units on non-corner lots. The ordinance would add group housing to this potential density bonus on RH-1 zoned lots and eliminate an owner occupancy requirement, opening up the number of sites that could qualify for this density increase. Making senior housing easier and more widespread. Currently, senior housing—which generally allows increased residential density—is only permitted within ¼ mile of an NC-2 zoning district or higher. The ordinance would eliminate this restriction, opening a wider area of the city for this much-needed type of housing. It would also eliminate an automatic CU requirement for senior housing in RH and RM districts that are not close to neighborhood commercial districts. Minimum lot width and area. The City’s minimum lot width would be reduced from 25 feet in most districts to 20, and lot area reduced from 2,500 square feet to 1,200. This would allow more residential density on some larger lots. Reducing rear yard requirement. San Francisco’s rear yard requirements are notoriously complicated and a regulation that often requires exceptions or limits the development potential of a property. The ordinance would make the rear yard requirement 25% of lot depth or 15 feet in most zoning districts. In certain “R” districts, the requirement would be 30% or 15 feet. It also includes a common-sense option for corner lot developments to provide an interior corner open area, saving the need for a variance or other entitlement. We should note that the legislative digest flags a few aspects of the residential streamlining proposal that do not appear to be included in the first draft of the ordinance. These may be added to subsequent versions of the legislation, and it could be amended as it is brought to the Planning Commission and eventually the Board of Supervisors. We will continue to track this important ordinance as it moves forward. We will also track other legislation that seeks to further implement the Housing Element. Authored by Reuben, Junius & Rose, LLP Attorney Mark Loper. The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.