As recently as last month, existing state law prohibited the sale of accessory dwelling units (“ADU”) from being sold or conveyed separately from the primary residence, except under specific circumstances where the ADU was built or developed by a qualified nonprofit corporation and held pursuant to a recorded tenancy-in-common agreement meeting certain requirements. Thanks to new state legislation – and depending on the city – the right of property owners to sell ADUs separate from primary residences has been considerably broadened. Drafted by Assemblyman Phil Ting (D-San Francisco) and signed into law on October 11, Assembly Bill 1033 provides a path forward for participating cities to adopt legislation authorizing the purchase and sale of ADUs as condominiums, regardless of whether the contractor was a qualified nonprofit or the manner in which the property is owned. The following summarizes the requirements of AB 1033 and provides guidance for homeowners in utilizing this change in law.

With respect to the construction of ADUs, Government Code § 65852.2 allows local agencies, by ordinance, to provide for the creation of ADUs in areas zoned for single-family or multifamily dwelling residential use. Among other requirements, any such ordinance must (i) designate areas within the jurisdiction of the local agency where accessory dwelling units may be permitted, (ii) impose certain objective standards on ADUs (such as parking, height, setback, landscape, architectural review, and maximum size), (iii) provide that ADUs do not exceed the allowable density for the lot upon which the ADU is located, and (iv) require ADUs be for residential use consistent with the existing general plan and zoning designation for its lot.

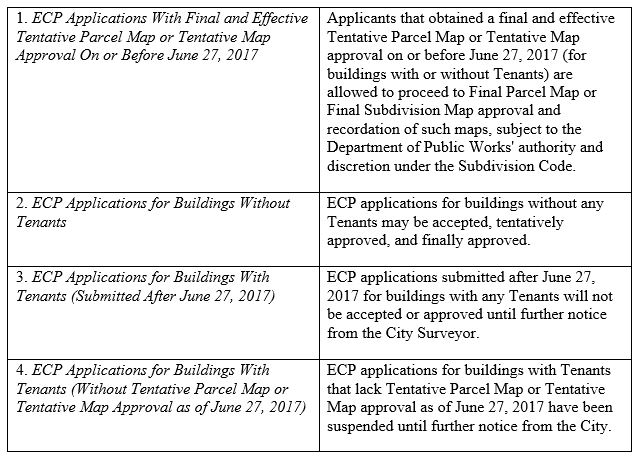

AB 1033 now allows cities to adopt ordinances that authorize the sale of ADUs – constructed in compliance with Gov. Code § 65852.2 – as condominiums, provided such ordinances meet the following requirements:

(1) The condominiums are created pursuant to the Davis-Stirling Common Interest Development Act, the state’s statutory scheme governing residential condominiums.

(2) The condominiums are created in conformance with all applicable objective requirements of the Subdivision Map Act, which governs subdivision mapping, and all objective requirements of applicable local subdivision ordinances.

(3) Before recordation of the condominium plan, a safety inspection of the ADU must be conducted, evidenced either through (i) a certificate of occupancy from the local agency or (ii) a housing quality standards report from a building inspector certified by the United States Department of Housing and Urban Development.

(4) Each lienholder of the applicable property must consent to the recording of a subdivision map and condominium plan before either of those documents may be recorded. With respect to lienholder consent, a lienholder may (i) refuse to give consent, or (ii) give consent provided that any terms and conditions required by the lienholder are satisfied.

(5) Prior to recordation of the condominium plan (or any amendments thereto), written evidence of the lienholder’s consent must be provided to the county recorder along with the following signed statement from each lienholder:

“(Name of lienholder) hereby consents to the recording of this condominium plan in their sole and absolute discretion and the borrower has or will satisfy any additional terms and conditions the lienholder may have.”

(6) The lienholder’s consent must be included on the condominium plan or a separate form attached to the condominium plan (and include certain information required by statute), and must be recorded in the office of the applicable county recorder.

(7) The local agency must also include a statutory notice to consumers on any ADU submittal checklist or public information issued describing requirements and permitting for accessory dwelling units.[1]

(8) If an accessory dwelling unit is established as a condominium, the local government must require the homeowner to notify utility providers of the condominium creation and separate conveyance.

(9) For owners of a property or a separate interest within an existing planned development with an existing association, as defined in Section 4080 of the Civil Code, such owners may not record a condominium plan without the written authorization by the association.

Under AB 1033, an ADU may be sold or otherwise conveyed separate from the primary residence where the above conditions are satisfied. While this is certainly an encouraging development in the fight to overcome the state housing crisis, many questions remain.

AB 1033 will only be as effective as the cities that choose to adopt the necessary legislation providing for the separate conveyance of ADUs as condominiums. As of this writing, the City of Santa Monica has passed a resolution directing staff to draft a conforming ordinance for consideration. No city has yet enacted an AB 1033-compliant ordinance.

Beyond the issue of city participation, the appetite of lienholders to consent to the mapping and sale of ADUs as condominiums is unclear. If the condominiumization of ADUs were to reduce the value of the principal residences acting as a secured asset, lenders may decline consent or grant consent while imposing onerous conditions on property owners.

Further, the market for the sale of ADUs as condominiums is an unknown quantity. It may prove difficult for property owners to sell ADUs as a condominium separate from a primary residence, and vice versa. Purchasing either interest would also subject owners to the rules and regulations applicable to homeowners’ associations, which can prove tricky for small, two-member associations, particularly when disputes arise.

Homeowners looking to sell ADUs should contact their local city officials and request information regarding the prospects for local adoption of an ordinance now authorized pursuant to California Government Code § 65852.2.

If you have any questions or would like to discuss the mechanics and implications of AB 1033, please contact Michael Corbett from Reuben, Junius & Rose, LLP, at 415.567.9000 or mcorbett@reubenlaw.com.

[1] See Gov. Code § 65852.2(a)(1)(10)(E) for the required notice.

Authored by Reuben, Junius & Rose, LLP Attorney Michael Corbett.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.