Last week, the Board of Supervisors voted to override Mayor London Breed’s veto and passed legislation that will effectively downzone certain historic districts in the C-2 zoning district. According to the San Francisco Chronicle, this is the first time the Board has overturned Mayor London Breed’s veto. It also marks a reversal of the trend towards increasing density and eliminating numerical density limits in the City.

In the C-2 zoning district, formed-based zoning currently applies east of or fronting Franklin Street/13th Street and north of Townsend Street, meaning that instead of numerical caps on the number of units, the density is controlled by other development standards like height, bulk, setbacks, open space requirements, etc. The switch to form-based zoning in portions of the C-2 zoning district was just enacted in July 2023 as part of the Downtown Economic Revitalization legislation, which was unanimously approved.

Now, the Board of Supervisors passed legislation to revert back to numerical density limits in the C-2 district for properties within the Northeast Waterfront Historic District, the Jackson Square Historic District, and the Jackson Square Historic District Extension. This will limit density based on the density ratio permitted in the nearest residential zoning district, but no less than one unit per 800 square feet of lot area. The legislation exempts projects utilizing the Commercial to Residential Adaptive Reuse Program from the numerical density limits.

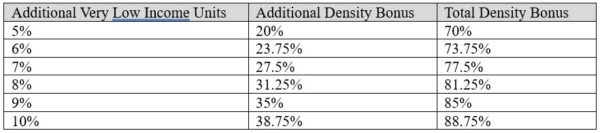

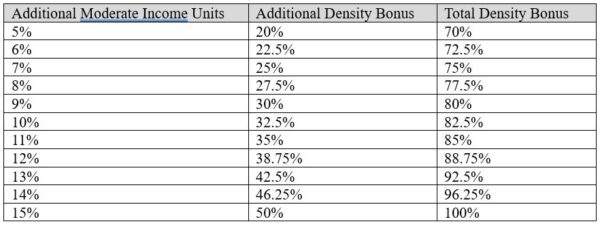

President Aaron Peskin, who sponsored the legislation, stated that it is a reaction to the “unintended consequence” of projects taking advantage of the form-based density in the C-2 zoning district in conjunction with the State Density Bonus Law to propose towers in these historic districts. Public comments specifically referred to State Density Bonus Projects at 1088 Sansome and 955 Sansome, which were proposing a total of 264 housing units.

The Mayor vetoed the legislation, calling it “anti-housing policy in the guise of historic protection.” Supervisors Melgar and Dorsey expressed concerns that as the City moves towards maximizing housing, this legislation would create a problematic precedent that individual supervisors can carve out exceptions to density decontrols. But ultimately, the Board voted 8-3 to override the Mayor’s veto, with Supervisors Melgar, Dorsey, and Engardio voting with the Mayor and against the legislation.

It remains to be seen whether these types of piecemeal exceptions to form-based density will continue to be enacted in response to specific projects. But either way, the Planning Department’s staff report aptly noted that a portion of the area affected by this legislation is currently included in the Planning Department’s rezoning effort in accordance with the Housing Element. If that rezoning scenario is pursued, the staff report states that the Department will likely recommend reinstating form-based density, and approximately 23 parcels that will be subject to numerical density controls under this legislation will revert to form-based zoning within the next year. This begs the question how many other areas will be subject to this type of legislative whiplash as the City grapples with balancing the need for additional housing and preserving neighborhood character.

Authored by Reuben, Junius & Rose, LLP Attorney Sabrina Eshaghi.

The issues discussed in this update are not intended to be legal advice and no attorney-client relationship is established with the recipient. Readers should consult with legal counsel before relying on any of the information contained herein. Reuben, Junius & Rose, LLP is a full service real estate law firm. We specialize in land use, development and entitlement law. We also provide a wide range of transactional services, including leasing, acquisitions and sales, formation of limited liability companies and other entities, lending/workout assistance, subdivision and condominium work.